Introduction

In 2025, managing money is smarter and more accessible. These finance apps use AI, automation, and real-time data to help users save better, invest wisely, and gain full control of their finances.

1. SmartWealth – AI Investment Manager

Category: Investing & Portfolio

SmartWealth grows your money intelligently:

- AI-managed portfolio allocation

- Real-time market analysis

- Risk profiling & personalized strategies

- Auto-investing features

- Performance tracking dashboard

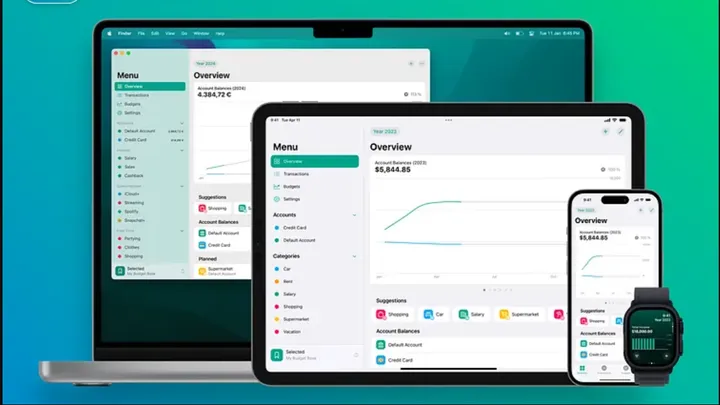

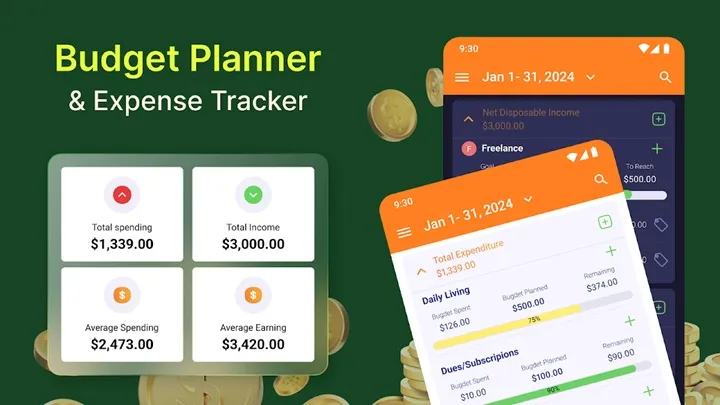

2. SpendSense – Smart Budget Planner

Category: Budget & Expense Tracking

SpendSense helps you master your spending:

- Automatic expense categorization

- AI-based savings suggestions

- Monthly budget planning

- Bill reminders and alerts

- Visual spending reports

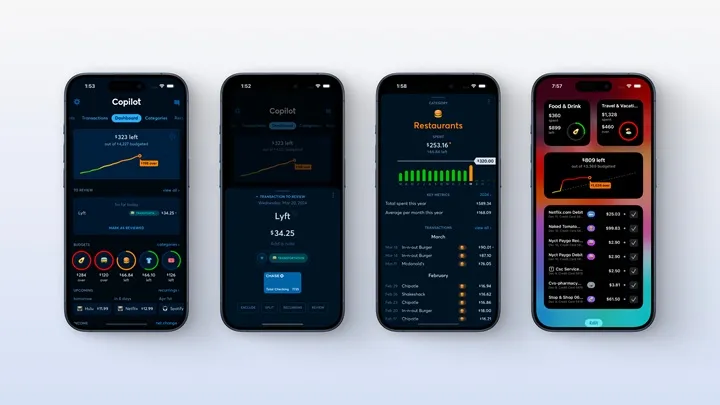

3. CryptoPilot – Advanced Crypto Manager

Category: Crypto & Digital Assets

CryptoPilot makes crypto easier:

- Multi-wallet management

- AI price prediction tools

- Secure transactions

- Market trend indicators

- Educational crypto guides

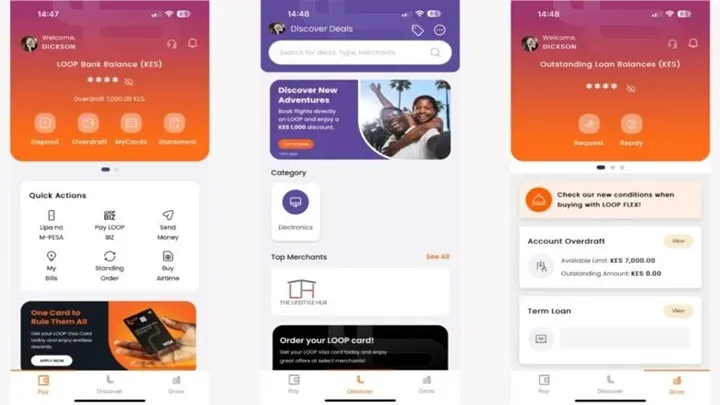

4. PayLoop – All-in-One Digital Wallet

Category: Payments & Transfers

PayLoop simplifies payments:

- Instant international transfers

- QR code payments

- Multi-currency support

- Biometric security protection

- Transaction history analysis

5. FutureFund – Goal-Based Savings App

Category: Saving & Financial Goals

FutureFund keeps you motivated:

- AI-powered savings goals

- Visual goal timelines

- Smart auto-deposits

- Reward system for consistency

- Financial habit tracker

Conclusion

The Top 5 Finance & Investment Apps of 2025 — SmartWealth, SpendSense, CryptoPilot, PayLoop, and FutureFund — give you smarter tools to save, invest, and grow your money with confidence.